Silver Eagles are one of the most famous and quite sought-after silver coins inside the global. Known for their purity and specific layout, they have got end up a symbol of wealth upkeep and a precious addition to any treasured metals series. Investors regularly pick out Silver Eagles for his or her reliability as a tangible asset that might preserve value over time. Whether you are a pro investor or new to the area of precious metals, knowledge the importance of Silver Eagles is vital for making informed funding choices.

Understanding the Value of Silver Eagles

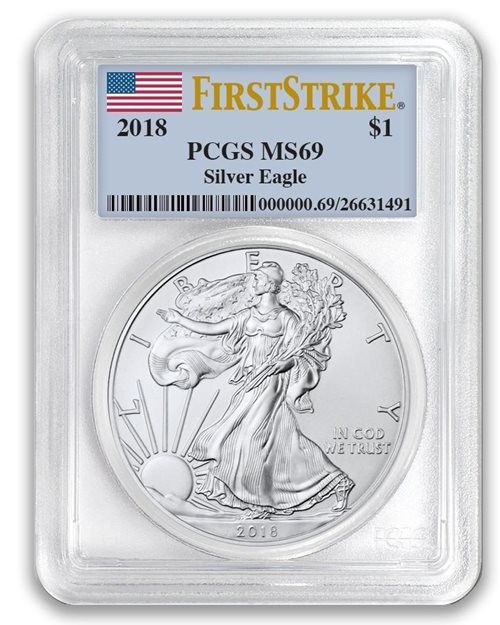

The cost of Silver Eagles is going past their face value. They are valued primarily based mostly on the silver content cloth they encompass, similarly to their rarity and demand inside the marketplace. These coins are minted by means of the U.S. Mint and contain one ounce of pure silver. Their charge fluctuates in reaction to the market price of silver, and creditors regularly factor of their situation, age, and minting versions. By owning Silver Eagles, traders gain get proper of entry to to a sturdy asset that can hedge towards inflation and economic uncertainty.

How to Buy Silver Eagles

Purchasing Silver Eagles is straightforward, but there are crucial factors to hold in mind. Buyers need to evaluate their desired resources for acquiring these cash, together with on-line dealers, coin shops, or auctions. Ensuring that you are shopping for from a very good provider is vital to guarantee the authenticity and best of the coins. The process generally consists of checking the modern-day silver expenses, knowledge the rates associated with every coin, and verifying the certification of authenticity whilst critical.

Silver Eagles as a Hedge Against Inflation

Silver Eagles are often considered as a hedge in competition to inflation. The growing fee of residing and the devaluation of currencies make precious metals, which include silver, a clever funding. As fiat currencies lose value through the years, Silver Eagles stay a shop of price, presenting buyers with a manner to guard their wealth. Silver has traditionally been used as a store of cost, and proudly owning Silver Eagles permits people to guard their economic future sooner or later of times of monetary instability.

Comparing Silver Eagles with Other Precious Metals

While silver is a valuable metallic, it's critical to observe Silver Eagles with other precious metals like gold and platinum. Each steel has its advantages, but silver is regularly more low-priced and to be had for regular customers. Silver Eagles, with their one-ounce weight and authorities-sponsored certification, are a great access issue for those new to making an funding in silver. They additionally offer the gain of liquidity, meaning they'll be with out difficulty sold and offered within the marketplace in comparison to different metals that can be much less liquid.

Ways to Invest in Silver Beyond Silver Eagles

Although Silver Eagles are a extraordinary desire, there are numerous ways to invest in silver. These encompass silver bars, rounds, and silver ETFs. Investors can diversify their portfolios via selecting notable kinds of silver based totally on their investment dreams. Bars and rounds can also provide a decrease top rate over the spot fee of silver, at the identical time as silver ETFs provide publicity to the silver marketplace with out the need to maintain physical silver. Each method of making an investment has its advantages and dangers, and it's critical to pick the one that aligns together with your monetary approach.

The Benefits of Owning Silver Eagles

Owning Silver Eagles comes with several blessings. First and foremost, they're a tangible asset that may be saved privately and securely. In instances of financial turmoil or market crashes, Silver Eagles can provide a sense of protection and stability. Additionally, proudly owning physical silver isn't subject to the equal dangers as virtual property or stocks. With their excessive degree of liquidity and call for, Silver Eagles are an attractive funding for those looking to diversify their portfolio.

How Silver Eagles Perform inside the Market

The typical overall performance of Silver Eagles inside the marketplace is cautiously tied to the fee of silver. While the price of silver can be unstable, Silver Eagles commonly keep their charge over the long time. As silver costs upward thrust, so does the fee of Silver Eagles. This makes them an top notch preference for the ones searching for to capitalize on the appreciation of silver within the market. Historical developments show that during intervals of financial uncertainty, the decision for for Silver Eagles regularly increases, fundamental to higher charges.

Storing Your Silver Eagles Safely

Once you've offered Silver Eagles, it's vital to save them well to protect their rate. Proper storage can make certain that your coins stay in pristine circumstance. Options for storage encompass domestic safes, monetary institution safety deposit bins, or professional storage offerings presented via treasured metals custodians. Each method has its very very own set of execs and cons, so it's critical to assess your safety desires and decide the first-rate answer primarily based mostly on comfort and rate.

Selling Silver Eagles: What You Need to Know

Selling Silver Eagles can be a truthful procedure, however it's important to recognize the market dynamics. When it comes time to promote, elements such as silver prices, the condition of your coins, and the decision for for Silver Eagles will impact your sale price. It's critical to pick a dependable patron to ensure you get a honest charge for your cash. Many sellers provide to shop for lower returned Silver Eagles at aggressive prices, however it's constantly wise to hold around and evaluate offers earlier than creating a very ultimate decision.

Tax Considerations When Investing in Silver Eagles

Investing in Silver Eagles may want to have tax implications that alter depending at the united states you are residing in. In some times, the sale of silver can be challenge to capital profits tax, at the equal time as others may additionally impose taxes at the prices paid over the spot fee. It's important to analyze your local tax legal recommendations and speak with a tax professional to understand the functionality tax liabilities related to your silver investments. By doing so, you may ensure that your funding technique is as tax-efficient as possible.

The Future of Silver Eagles as an Investment

The destiny of Silver Eagles as an funding seems promising, in particular given the developing call for for silver and the ongoing monetary uncertainty. As silver stays a valuable asset for hedging closer to inflation and diversifying portfolios, Silver Eagles will possibly stay a staple inside the precious metals market. For buyers seeking to add a tangible and traditionally dependable asset to their portfolio, Silver Eagles offer prolonged-term fee and functionality for growth.

Conclusion: Why Invest in Silver Eagles?

In conclusion, silver Eagles for sale provide an excellent possibility for those seeking to put money into silver. As a tangible and dependable asset, they offer a way to guard wealth and hedge towards inflation. There are many methods to spend money on silver, however Silver Eagles stand out because of their purity, certification, and demand. Whether you're seeking out a stable asset for the duration of instances of economic uncertainty or seeking to diversify your portfolio, Silver Eagles stay an appealing option for consumers worldwide.